The Following Information Is Available for Wildhorse Co.

Paid 6200 on August 31 for 5 months rent in advance. In millions Wildhorse Co.

Answered The Following Information Is Available Bartleby

Has determined its December 31 2020 inventory on a LIFO basis at 953000.

. Prepare a 2020 pension work sheet for Wildhorse Corporation. The following information is available for Wildhorse Co. And cash balance on January 1 11890.

Your answer is partially correct. Expected cash receipts 58070. At December 31 2020.

Beginning cash balance 28800 Accounts payable increase 6840 Depreciation expense 49200 Accounts receivable decrease 5760 Inventory decrease 3720 Net income 68640 Cash received for sale of land at book value 124800 Cash dividends paid 45600 Income taxes payable. Vision College of Education Samungli Town Quetta. Accounts receivable 2100 Cash 6340 Accounts payable 4300 Supplies 3840 Interest payable 540 820 Unearned service revenue Service revenue Salaries and wages expense 5500 41300 Notes payable Salaries and wages payable 820 Common stock 31000 51400 2950 730 Depreciation expense.

And cash balance on January 1 11700. Accumulated other comprehensive income of 564 million on December 31 2019. The following information is available for Wildhorse Co.

Chapter 2 Exercise 6pdf. Prepare a basic cash budget for the month of January. The following information is available for Wildhorse Co.

Expected cash receipts 59240. The following information is available for Wildhorse Co. Has 13000 shares of 5 100 par value cumulative preferred stock and 26000 shares of 1 par value common stock outstanding at.

Trading securities fair value 116000 Available-for-sale securities fair value 84000 Held-to-maturity securities amortized cost 94000 Wildhorse will report securities in its long-term investments section of 178000 or an amount less than 178000 depending on the circumstances. Expected cash disbursements 66850. Expected cash disbursements 66900.

The following information is available for Wildhorse Co. 2022 2021 23 12 Pina Colada Corp. Unit contribution margin Prepare a CVP income statement that shows both total and per unit amounts.

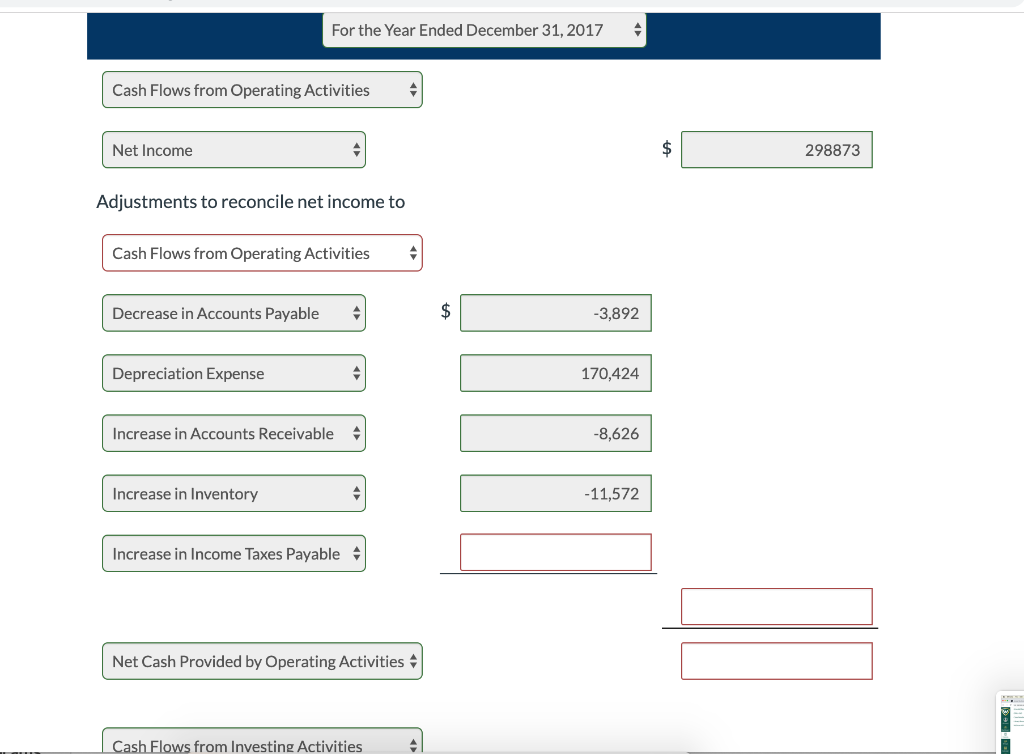

Statement of Cash Flows Indirect Method For Year Ended December 31 2022 I. For the month of January. 54000 Beginning cash balance Accounts payable decrease 4440 Depreciation expense 194400 Accounts receivable increase 9840 Inventory increase 13200 Net income 340920 42000 14400 Cash received for sale of land at book value Cash.

The following information is available. Capitalized leases 567000 Trademarks 269000 Long-term receivables 223000 In Cranes balance sheet. Adjusts its accounts annually.

Management wishes to maintain a minimum cash balance of 8230. Adjustments to reconcile net in View the full answer. Accounts receivable 2100 Cash 6340 Accounts payable 4300 Supplies 3840 Interest payable 540 820 Unearned service revenue Service revenue Salaries and wages expense 5500 41300 Notes payable Salaries and wages payable 820 Common stock 31000 51400 2950 730 Depreciation expense Equipment.

2022 2021 0 28 520 475 515 540 Preferred dividends Net income Shares outstanding at the end of the year Shares outstanding at the beginning of the year 210 195 145 185 195 145 185. Management wishes to maintain a minimum cash balance of 8160. The following information is available.

Question 5 Wildhorse Co. Expected cash disbursements 66210. The following information is available for Wildhorse Co.

The following information is available for the current year. Wildhorse Company has the following information available for September 2020. Capitalized leases 545000 Trademarks 285000 Long-term receivables 232000 In Blossoms balance sheet.

Unrealized holding loss of 112 million related to available-for-sale debt securities during the year. Expected cash receipts 59320. For the year ended December 31 2020.

At December 31 2017. Quiz 7 Question 1 The following data is available for Windsor Inc. The following information is available for the year ended December 31 2020.

The following information is available for Wildhorse Co. For the year ended December 31 2017 Wildhorse Co. At October 31 2017 is shown below.

The following information was available for Wildhorse Co. The following information is available for Wildhorse Co. Samungli Town Quetta ACCOUNTING MISC.

For the year ended December 31 2022. Accounts receivable 2100 Cash 6340 Accounts payable 4300 Supplies 3840 Interest payable 540 Unearned service revenue 820 Salaries and wages expense 5500 Salaries and wages payable 820 Notes payable 31000 Depreciation expense 730 Common stock 51400 Equipment net. Assuming no other changes in.

The following information is available for Wildhorse Co. Net income 309000 Preferred dividends declared 48200 Common dividend declared 9200 Unrealized holding loss net of tax 4600. Wildhorse Corporation Pension Work Sheet - 2020 General Journal Entries Annual Pension Items Expense Cash Balance Jan.

Prepare a basic cash budget for the month of January. Wildhorse Quest Games Co. For the year ended December 31 2017.

The following information is available for Wildhorse Co. The following information is available for Wildhorse Co. For the month of January.

Accounting questions and answers. Owns the following investments. The following information relates to Wildhorse Co.

And Pina Colada Corp. Cost of goods sold 852000. Beginning cash balance Accounts payable decrease Depreciation expense Accounts receivable increase Inventory increase Net income Cash received for sale of land at book value Cash dividends paid Income taxes payable increase.

For the year ended December 31 2022. At December 31 2020 the following information was available from Crane Cos accounting records. For the month of January.

Cash flow from Operating Activities Net income 340920 Add. Net income 292000 Preferred dividends declared 51200 Common dividend declared 9500 Unrealized holding loss net of tax 5700. The answers for this statements is in the photo that I have given.

The following information is available for Wildhorse Co. 1 2020 a Past service cost b Current service cost c Net interestfinance cost d Asset remeasurement loss e Contributions f Benefits paid Expense entry - 2020 5 Contribution. Common stock par 10 authorized.

Wildhorse inventory turnover ratio in 2017 was Use 365 days for calculation. Part Level Submission The bank portion of the bank reconciliation for Wildhorse Co. Cost Retail Inventory 1120 135000 191000 Purchases.

Accounts receivable 2100 Cash 6340 Accounts payable 4300 Supplies 3840 Interest payable 540 820 Unearned service revenue Service revenue Salaries and wages expense 5500 41300 Notes payable Salaries and wages payable 820 Common stock 31000 51400 2950 730 Depreciation expense. Bank Reconciliation October 31. For the year ended December 31 2017 Wildhorse Co.

Purchased a 1-year insurance policy on June 1 for 1500 cash. Net income 1305 million. The following information is available for Carla Vista Co.

Unit selling price of video game consoles 570 Unit variable costs 456 Total fixed costs 38760 Units sold 600 Compute the unit contribution margin.

Solved The Following Information Is Available For Chegg Com

Solved Your Answer Is Partially Correct The Following Chegg Com

Solved The Following Information Is Available For Chegg Com

Solved Question 8 Wildhorse Co Began Operations On January Chegg Com

No comments for "The Following Information Is Available for Wildhorse Co."

Post a Comment